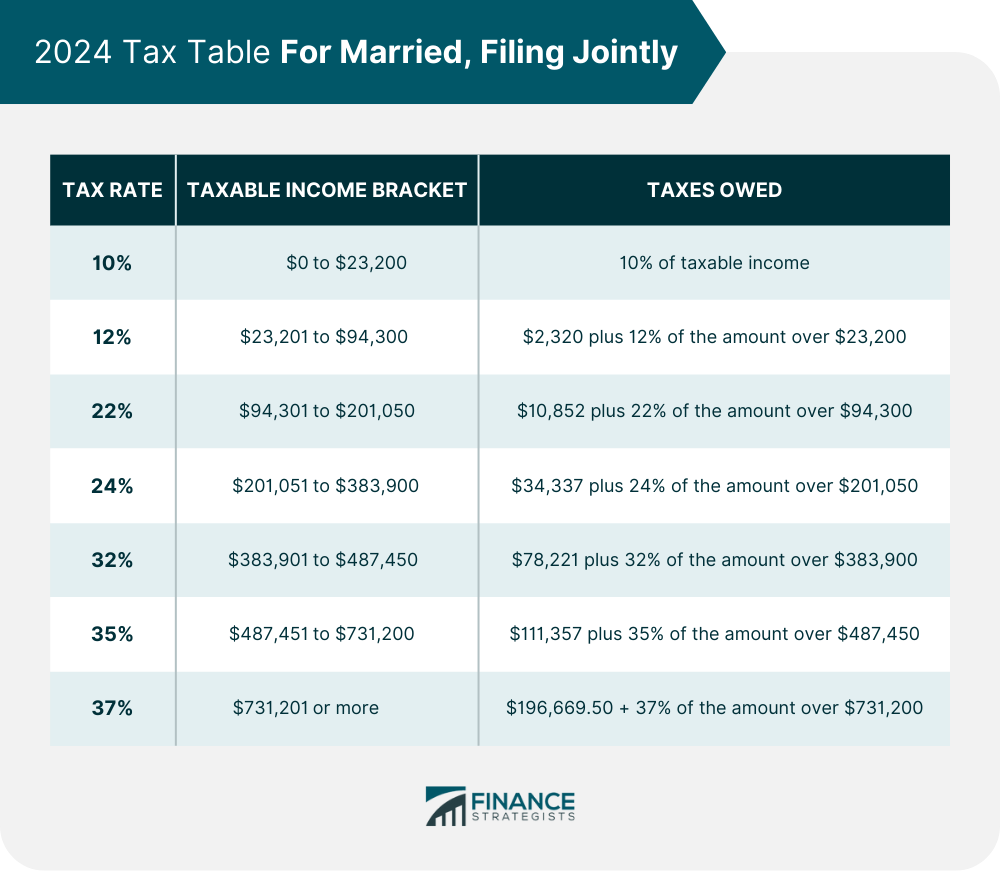

2025 Married Tax Brackets Married Jointly. Tax rate taxable income (single) taxable income (married filing jointly) 10%: For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

At the start of this year, you. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Tax Brackets 2025 For Married Filing Jointly Eunice Catlaina, Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much you pay in federal income.

2025 Tax Brackets Irs Married Filing Jointly Myra Tallia, 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets Married Filing Jointly Irs Vivi Yevette, Generally, as your income increases,.

2025 Tax Brackets Married Jointly Married Filing Tommi Gratiana, 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Brackets 2025 Married Jointly Over 65 Dannie Emeline, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Us Tax Brackets 2025 Married Filing Jointly Vs Separately Gustie Germain, Tax rate taxable income (single) taxable income (married filing jointly) 10%:

Tax Bracket For 2025 Married Filing Jointly Lizzy Camilla, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Tax Brackets Definition, Types, How They Work, 2025 Rates, The federal income tax has seven tax rates in 2025:

2025 Tax Brackets Calculator Married Jointly Bridie Sabrina, $29,200 for married couples filing jointly.

Irs Tax Rates 2025 Married Jointly Daryn Emlynne, Married filing jointly or qualifying surviving spouse.